Many companies have the need to send or receive commercial samples to motivate future sales, either so that a potential buyer knows the product or to determine any possibility of new exports or imports.

Let's start a path together in national and international trade.

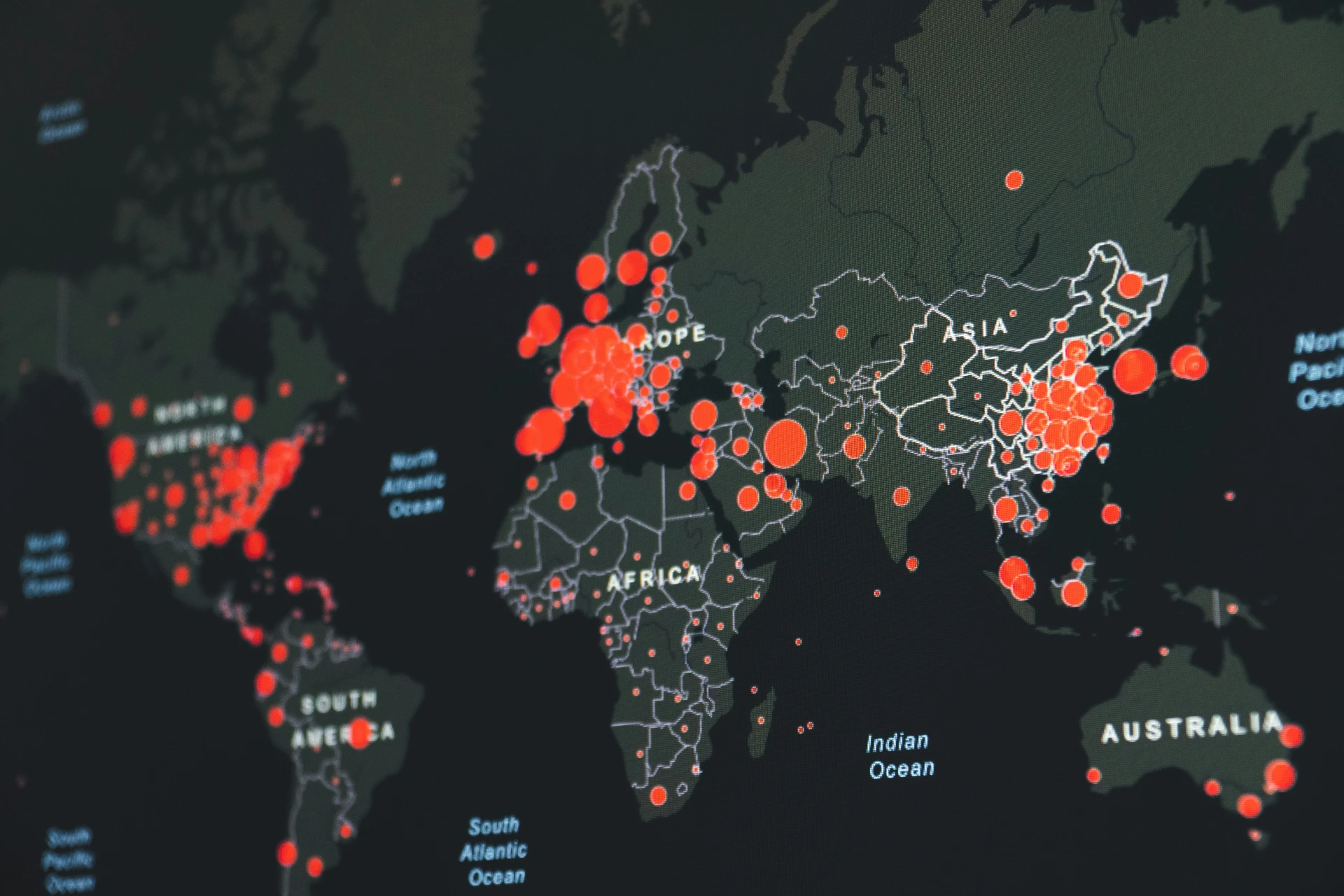

National and International market research

Identification commercial market statistics

International Commercial Market

Customs

-

Registrations in AFIP as Importer, Exporter, Representative and Reliable Operator.

-

DJVE processing.

-

Tariff classification.

-

Processing of SIMI and-automatic licenses..

-

Management and collection of refunds.

-

Transshipment operations.

-

Valuation of merchandise to be exported before Cutoms

Contact us

Exportación

-

Negotiation and reservation of pallets and containers.

-

Consignment destinations.

-

Transportation from factory to warehouse.

-

Opening of letter of credit.

-

Shipment of letter of credit.

-

Certificate of origin.

-

Winery reservation.

-

Factional and staggered shipments.

-

Coordination with control and fumigation companies.

-

Hiring insurance for merchandise.

-

International Moving.

Contact us

Import

-

Analysis of costs, budgets and tariffs.

-

Transportation from warehouse of factory.

-

Extensions.

-

Nationalization.

-

Cargo coordination with exporters.

-

Temporary destinations, CTC processing.

-

Placement of purchase orders.

-

International Moving.

Contact us

Other

-

Customs transits.

-

Operations in fiscal warehouse, plants and terminals.

-

Management and processing before regulatory and official bodies.

-

Preparation and freight reservations.

-

Negotiation and freight reservations.

-

Door-to-door merchandice planning.

-

Consolidation and deconsolidation.

-

Negotiation with Forwarders.

-

Claims before insurers.

-

International insurance contracts.

Contact us

Containers

Customs Advisory Services

Customs advisory for organizations or individuals wishing to export and import.

We accompany you in the day-to-day operations of foreign trade.

Advisory on the customs valuation of your merchandise.

Advisory on customs infraction.

Customs Regimes

This covers door-to-door postal shipments, which include parcels of up to 50kg from or to abroad. This regime includes correspondence of forms, lists, documentation, among others.

This has as its objective the total or partial restitution of the amounts that had been paid in connection with taxes that levied on importation for consumption. In the legislature of the Argentine Republic, the Import duties and the Statistical Fees are restored.

In this, the amounts that would have been paid as internal taxes for the merchandise that is exported for consumption are fully or partially restored.

Unlike the previous ones, here the amounts that would have been paid for internal taxes and import taxes for consumption are refunded. This type of remuneration is not compatible with the reimbursement and drawback regimes.

Due to the movement of international trade, different means of transportation arrive and depart in the country. These means need certain merchandise to fulfill their specific function, such as on-board provisions and supplies.

In imports and exports, crew members, mainly in air and sea routes, take new or used effects that are considered for the trip only for use or for personal consumption, this is called the crew's luggage on board.

Through General Resolution 4049-E and its modifications, the AFIP established certain benefits for those interested in exporting, being able to carry out exports without the intervention of a customs broker. They have limits on exportable amounts in their transactions.

Works of art are widely traded globally. The Argentine Republic is an interesting exporter of this type of goods and has special regulations that promote this trade, with this type of merchandise being exempt from payment of all surcharges, customs or port fees, including statistical or storage fees, tax on freight and consular expenses.

Let's make those ideas come true together

National and International Business Development

We plan and execute your idea, entrepreneurship, SME together, communicatively accompanying you in all processes.

Contact usMarketing Multicultural B2B, B2C y C2C

Adopting this type of strategies involves recognizing potential clients from different cultures, with different behaviors and values. These multicultural consumers are increasingly eager to try foreign products, which are popular in different and distant places.

Contact usAdvice and Insertion of products and/or services

- Measurement of business results or experimentation by identifying different types of indicators.

- Prioritize initiatives and develop strategic roadmaps differentiating short, medium and long term.

- Carrying out benchmarks on markets to understand each industry with business characteristics and features.

Business Analytics

- Understand and define metrics and KPIs of the different business models.

- Carrying out benchmarks on markets to understand each industry with business characteristics and features.

- Map the different stakeholders, internal and external dependencies of a business.

Incoterms® rules are a set of standards used in national and international contracts for the delivery of goods. They are recognized by UNCITRAL as the global standard for the interpretation of the most common terms in foreign trade, helping to avoid costly misunderstandings by clarifying the reasons, costs and risks involved in the delivery of goods from sellers to buyers and vice versa.

It represents the minimum obligation for the seller, which consists of providing the goods at its facilities (factory, factory). The buyer bears all costs and risks involved in transporting the merchandise from there to the desired destination. It is used in any mode of transport.

It is placed at the agreed delivery location. The seller has fulfilled his obligations when he has placed the goods cleared through customs for export in charge of the carrier appointed by the buyer at the agreed place. It is used in any mode of transport.

The seller fulfills his obligations by delivering the goods alongside the ship at the named port of destination, on a dock or on barges. It is exclusively for the sea route.

The seller places the merchandise on board the ship at the port of shipment agreed in the purchase-sale contract. The risk of loss or damage is transferred from the seller to the buyer when the merchandise is delivered on board the ship, the concept of the ship's rail and its imaginary line disappears. Stowage costs at the port of departure, borne by the exporter, are included. It is used exclusively for sea routes.

It is placed at the agreed destination, just like the "CFR" incoterm, the seller pays the freight of the merchandise to the agreed destination. It is used in any means of transport.

The seller has to pay the costs and freight to take the merchandise to the agreed port of destination. The price includes the merchandise placed at the port of destination with freight paid but insurance not included. The abbreviation is followed by the name of the destination port. It is exclusively for sea routes.

The seller pays for freight and transportation insurance against loss or damage to the merchandise during transportation. It is used in any mode of transport.

This is similar to the commercial conditions of the "CFR" incoterm, however the seller has to carry out maritime insurance against the risk of loss of the merchandise during transportation. It is exclusively Maritime.

It is placed at the agreed destination. Refers to deliveries in the destination country at an agreed location. Referring that the merchandise is delivered ready for unloading.

The seller pays for freight and transportation insurance against loss or damage to the merchandise during transportation. It is used in any mode of transport.

The agreed destination is placed: It must always be accompanied by the reference of an exact place. It is used in any mode of transport.

Your question does not bother us

Phone

+54 9 341 6746952

Working Hours

Monday to Friday

8 hs a 14hs

ventas@argotcomex.online info@argotcomex.online

Complete the form below to ask any questions or contact us directly info@argotcomex.online

Who We Are

Argot is a foreign trade consulting firm that was born in 2023, including other services that are not exclusively in the field of international transactions. Constituted from an idea and vision that is the incorporation of a new approach based on business technological evolution, including some of these such as startups, data analysis and business analysis with the implementation of software and other methods. This venture has trained and certified people, experts in different specifications. Finding ourselves in need as freelancers that perhaps individually it is more difficult to find the first projects, the main objective is a collaborative environment of exchange regarding ideas, projects, solutions, thoughts, experiences, etc.

We speak the same language...

Vision

Provide the best advice by making available our knowledge and experience in projects for mutual benefit.

Objetives

Provide a comprehensive solution to each project, creating cultures for global integration.